Catalytic Capital in Action: Tory Dietel Hopps Presents at the Federal Reserve Bank of Boston

On April 11th, our Managing Partner, Tory Dietel Hopps, presented at the Federal Reserve Bank of Boston as part of a panel on, “Good Impact Investing Needs Grants Too.”

Grants: The Often‑Missing Catalyst

Tory opened by mapping the spectrum of capital, from traditional investing to pure philanthropy, and highlighted the “catalytic gap” where relatively small grants can de‑risk and accelerate larger, mission‑aligned deals.

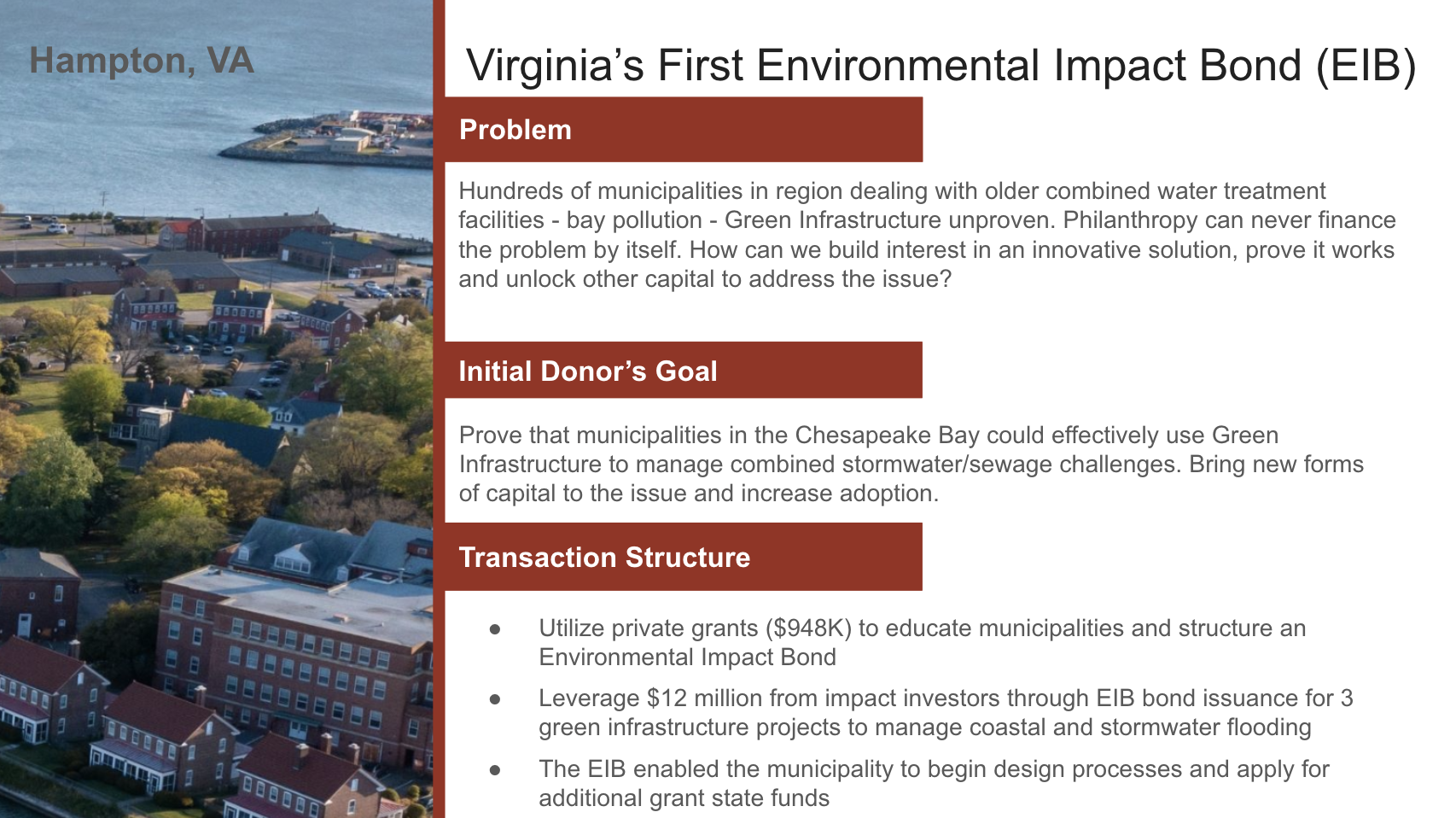

Case Study: Virginia’s First Environmental Impact Bond

Problem we set out to solve: Hundreds of Chesapeake‑Bay municipalities rely on aging combined sewer systems that overflow during storms, polluting the bay; large‑scale green‑infrastructure solutions were still unproven, and philanthropy alone could never cover the price tag. The challenge was to spark interest in an innovative approach, prove it works, and unlock other capital to tackle the issue.

Solution:

$948K in private grants paid for education and transaction design.

Those grants leveraged $12 M in impact‑investor capital for three green‑infrastructure projects.

Proven success unlocked an additional $24 M in state and federal funds, turning less than $1 M in philanthropy into $36 M of total capital—a 36‑to‑1 multiplier.

Outcomes included above‑target storm‑water storage, new local jobs, and a replicable model now available to cities nationwide.

Takeaways

Blend capital intentionally. Philanthropy can (and should) sit beside private and public dollars.

Invest in knowledge. Early technical assistance—funded by grants—creates a pipeline of bankable projects.

Tie returns to impact. Performance‑based structures build confidence for investors and communities alike.

Tory’s presentation underscores our commitment to demonstrating that well‑placed grants can unlock far greater mission‑driven capital and the importance of looking for “trim tab” opportunities with grant money.